While debate goes on about the future of the Affordable Healthcare Act (ACA), ACA-related tax reporting is still required for 2016, Greatland Corporation is offering some last-minute insights about who needs to file, what tools can help, and status of final deadlines.

While the due dates for 1095-B and 1095-C paper forms have passed, businesses have until March 31, 2017 to e-file 1095 forms to the IRS.

Greatland gives businesses the opportunity to e-file until 8 p.m. EST on March 31 with guaranteed deadline compliance. This feature offers additional hours of reporting time, and still days later than other online services.

ACA reporting via 1094 and 1095 forms was required last year, and employers and insurers are again expected to comply with all ACA reporting requirements, making it imperative that businesses understand the new requirements for 2016. In 2015, the IRS initiated ACA reporting with a “good-faith effort” guideline for businesses to encourage participation, and did not aggressively penalize errors. The “good-faith effort” leniency was extended for the 2016 reporting season. However, businesses should still do all they can to accurately complete their forms and file all documents on time to avoid penalties and fines.

As a reminder, employers with 50 or more full-time employees (including full-time equivalent employees) and all self-insured employers regardless of size must report healthcare coverage information to employees and the IRS. Full-time employees are those who worked an average of 30 hours or more per week for more than 120 days in a year. Using this guideline, you may have less than 50 full-time employees, but meet the requirements for ACA reporting. Healthcare.gov offers assistance, including a Full-time Equivalent Employee Calculator, to help determine filing needs.

If you are an insurance company or business that is required to report healthcare coverage, you will need to file one of two form types to the federal government. Both paper and e-file are acceptable filing methods, with the e-file threshold being 250 forms.

- 1095-B – The Internal Revenue Code (IRC) Section 6055 outlines the requirements for 1095-B reporting. Form 1095-B must be issued by the insurance company (or self-insured employer) to the individual and the IRS as proof of coverage. Form 1094-B is the related transmittal sent to the IRS.

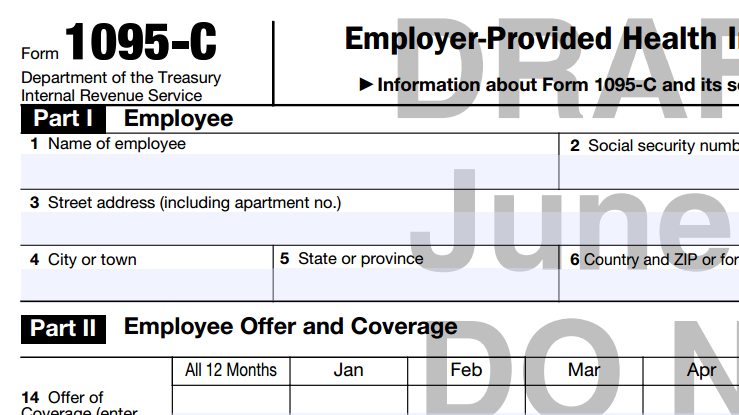

- 1095-C – IRC Section 6056 defines the reporting requirements for large employers (50 or more full-time employees including full-time equivalent employees) to provide their employees with documentation outlining any applicable offer of health coverage. Form 1095-C is a statement issued by employers with 50 or more full time employees (including FTEs) to employees and the IRS. Form 1094-C is the related transmittal sent to the IRS.

Greatland has found that one of the biggest headaches for businesses is the completion of Lines 14-16 on Form 1095-C, the form used to provide employees with information about their medical benefits. This section has proven to be so unclear that many businesses pay high fees to have a third party calculate the required codes for them. Greatland’s team of ACA compliance experts created a free ACA Code Generator tool to help demystify the process, allowing businesses to complete this critical step on their own. Simply answer a few questions and this tool will guide you towards the correct codes to enter in Lines 14-16 of Form 1095-C.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs